Our Approach

BrookStreet's approach to portfolio management is typically systematic. We help determine a client's attitude to risk and capacity for loss. We run financial models to help with cash flow planning and establish a client's financial goals and aspirations. We then recommend a core portfolio that reflects their risk tolerance. We also design satellite strategies to help them customise their portfolio. We do not attempt to time the market or identify very short term trends with individual securities. Instead, we apply a disciplined and evidence-based approach to design an investment strategy that is crafted to reflect a client's unique goals and risk appetite so as to give them the greatest likelihood of achieving their financial goals.

Our investment process is guided by well researched financial principles that provide a framework for building portfolios to meet our client's long-term investment goals. Our 3-step process includes:

01

We learn a bit

about our clients

In Step 1, we learn about our client's investment objectives. Where they are in their financial life and what are they investing for? Retirement? Children's education? What is the investment horizon and how much risk is acceptable to them? We then determine how a client's investment assets will need to perform to achieve their goals. We also believe that they should know the amount of risk that is necessary to accomplish their goals. That way they understand the trade-offs between short-term volatility and their long-term financial security.

02

We build a custom

portfolio for our clients

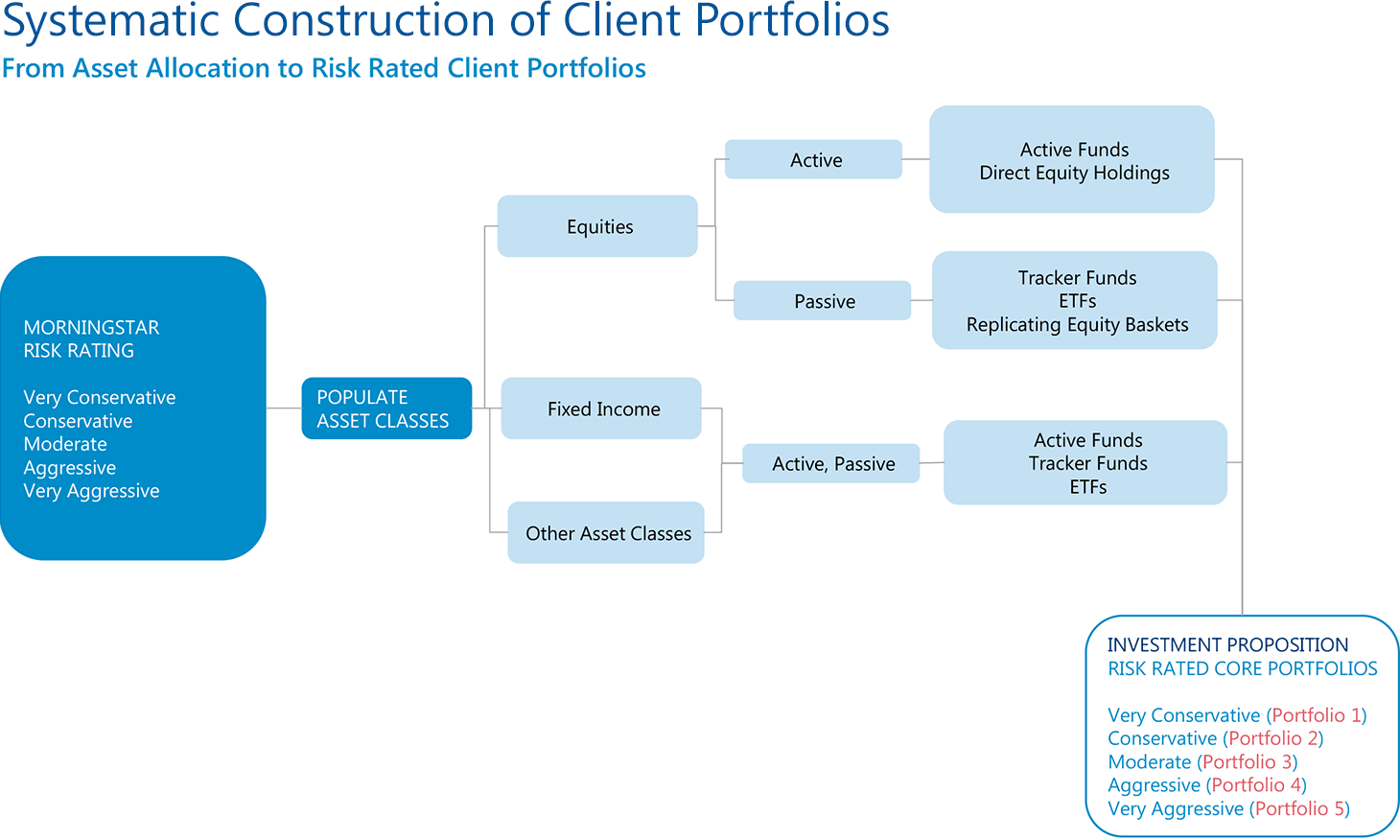

In Step 2, we construct the investment portfolio. This is the most important part of the investment process. It starts with asset allocation where we determine the combination (or allocation) of investment categories (or asset classes) that seems most likely to achieve our client's investment objectives. Asset allocation is the primary determinant of the variation in a portfolio's performance, more so than security selection or market timing and can help minimise losses and protect portfolios against volatility and uncertainty. That's why BrookStreet uses tools used by global investment firms, to identify a client's risk tolerance and investment goals to build risk-rated diversified portfolios.

Next is the selection of appropriate securities, active or passive, within a portfolio once the target mix of asset classes have been defined (equity, debt, cash, etc.). For active sleeves, we select those funds or strategies that offer an attractive risk/reward proposition according to quantitative rankings and a thorough due diligence process. For passive exposures, a focus on close tracking of an index, liquidity and cost are paramount considerations.

BrookStreet uses various advanced techniques in constructing core and satellite portfolios. Depending on the strategy, portfolio construction could involve heuristic, optimisation or simulation based techniques. Single or dual objective functions such as minimising volatility are frequently employed.

03

We manage and

monitor a client's portfolio

In Step 3, we manage and monitor the investment portfolio with discipline. Regular rebalancing combined with ex-ante risk management and ex-post risk attribution and analysis are key functions of this step. Every quarter, we will send clients a portfolio performance report of our model portfolios along with the past quarters' economic and investment climate as well as our outlook for the future along with year to date performance.

Our clients use the Quarterly Review Report to: